On February 22, 2023, the U.S. Department of Housing and Urban Development (HUD) announced a 30 basis points (bps) reduction to the FHA Annual Mortgage Insurance Premium (MIP) rates charged to homebuyers who obtain an FHA Loan.

What does it have to do with Homeowners?

It means savings for FHA loan borrowers! Hooray!

The Annual Mortgage Insurance Premium (MIP) is required by the government on all FHA loans for added financial protection of the lender. With FHA Loans, this protects the federal government in the event a borrower defaults on a mortgage.

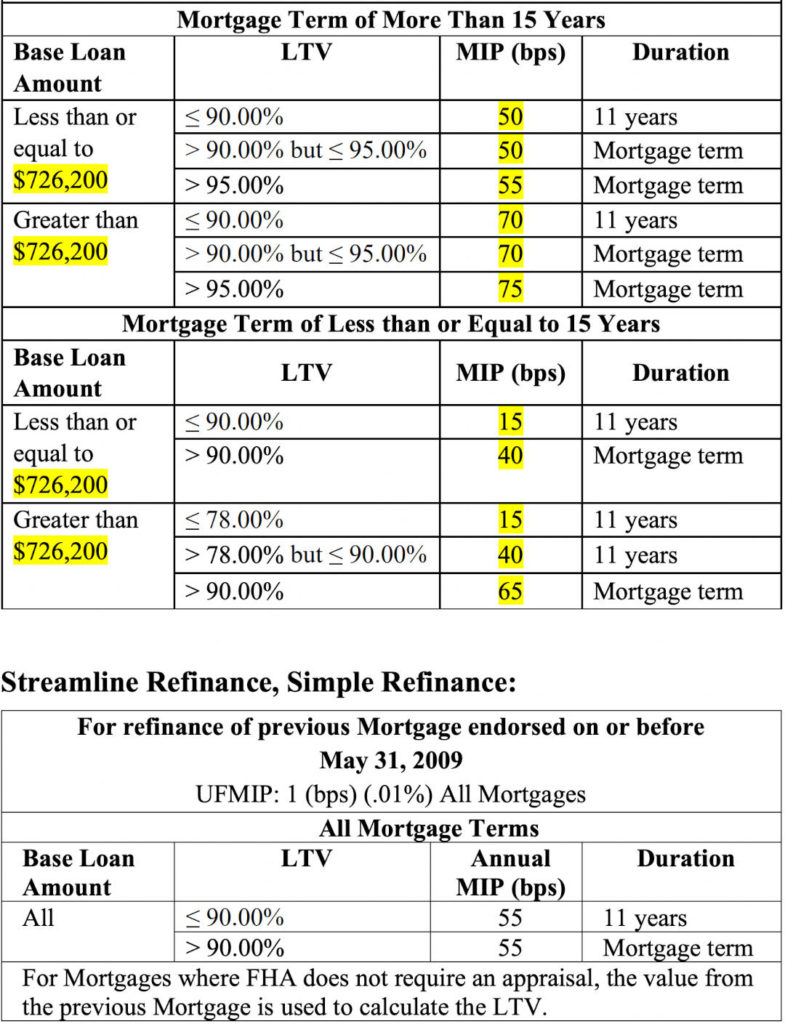

The Annual MIP is calculated every year and paid once a month as opposed with an Upfront Mortgage Insurance Premium (UFMIP) that each borrower is required to pay at closing. The cost and the duration of paying the annual MIP depend on the loan-to-value (LTV), loan amount and length of mortgage terms.

With this MIP reduction, Borrowers can save a huge amount of money in total and they can be assured of saving a few hundred of dollars on their monthly mortgage per year.

Please refer to the image below of the new MIP Rates:

The reduction is effective for mortgages endorsed for insurance by FHA on or after March 20, 2023 but some Lenders have already implemented this change. If you currently have an FHA Loan, you can avail of this MIP reduction when you refinance.

Talk to your Loan Officer if you have additional questions about this.